A virtual terminal is especially valuable in industries or situations where in-person card processing isn’t practical, such as handling reservation deposits, accepting donations, and over-the-phone B2B transactions, among others. Modern payment service providers offer virtual terminals that are secure, flexible, easy to set up and use, and provide fast access to funds.

To help you find the best fit for your business, I evaluated the best virtual terminals of 2025:

Best virtual terminals compared

(out of 5) |

|||||

|---|---|---|---|---|---|

| From Interchange plus 0.15% + 15 cents | One-time, recurring (card vault), refund, Level 2/3 data | ||||

| 3.5% + 15 cents | One-time, recurring (card vault), refund | ||||

| Custom interchange plus | One-time, recurring (card vault), refund, Level 2/3 data | ||||

| 2.7% to 4.3%* | One-time, recurring (card vault), refund, Level 2/3 data, international | ||||

| 3.5% + 10 cents | One-time, recurring (card vault), refund, Level 2/3 data, international | ||||

| 3.39% + 29 cents | One-time, recurring (card vault), refund, international | ||||

| *Typical PaymentCloud fees; actual costs are customized | |||||

Also see: Best Payment Processing Companies

Helcim: Best for B2B merchants

Our rating: 4.58 out of 5

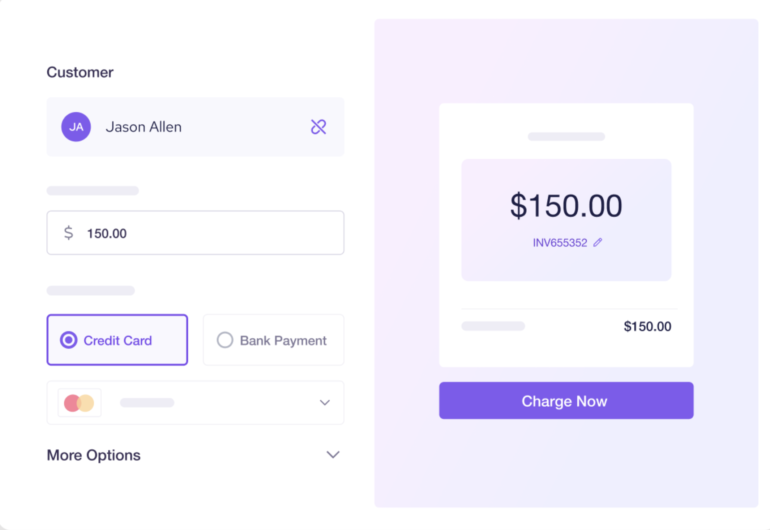

Helcim is a traditional merchant account service provider that also offers a full suite of payment services, including point of sale (POS), online checkout, and invoicing. It is famous for its interchange-plus pricing with built-in volume discounts and other automations geared toward cost optimization.

Why I chose Helcim

Helcim solves the common challenge of high, opaque fees in virtual terminals by offering transparent interchange-plus pricing with no monthly fees or long-term contracts. Its browser-based terminal is ideal for B2B businesses, providing flexible invoicing, customer profiles, and recurring billing tools that support complex payment workflows. What I particularly like is Helcim’s automated level 2 and 3 data processing, so B2Bs are always getting the lowest rates possible.

However, Helcim’s features work within its ecosystem, so workflow integration with your current system will require a developer-based setup that takes longer to complete.

Pricing

- Monthly account fee: $0

- Virtual terminal fee: $0/month

- Card-present rate: Interchange plus 0.15% + 6 cents to 0.4% + 8 cents

- Card-not-present rate: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

- Keyed-in rate: Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

- American Express transactions: + 0.10% + 10 cents

- ACH fee: 0.5% + 25 cents per transaction

- Invoice fee: $0

- Chargeback fee: $15 refundable

Features

- Supported payment methods: Full suite of payment services, including credit and debit card processing, ACH payments, and invoicing that’s accessible both online and in person through its POS and virtual terminal.

- Integration capabilities: Direct integrations with QuickBooks Online, WooCommerce, and Zapier enable connections with CRMs, inventory, and invoicing platforms; offers an open API for developers to build custom integrations.

- Scalability: Provides multi-user access with customizable roles, supports white-label branding, and provides advanced analytics with auto-synced inventory and recurring billing, enabling efficient business expansion.

- Workflow integration: Functions as a stand-alone all-in-one commerce platform with a virtual terminal that already integrates with the native POS, inventory management, customer profiles, and recurring billing into a unified system.

- Security: Secures virtual terminal transactions with end-to-end encryption, PCI Level 1 compliance, and tokenization to protect sensitive customer payment data. It also includes built-in fraud detection tools and HTTPS protocols to ensure secure, reliable payment processing across all touchpoints.

- Ease of use and setup: Offers a straightforward onboarding process with approval typically within 24 to 48 hours, though it requires more business details upfront than Square. Its clean interface, guided setup, and access to educational resources, including live onboarding calls, make it exceptionally user-friendly.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Square: Best for all-in-one POS solution

Our rating: 4.4 out of 5

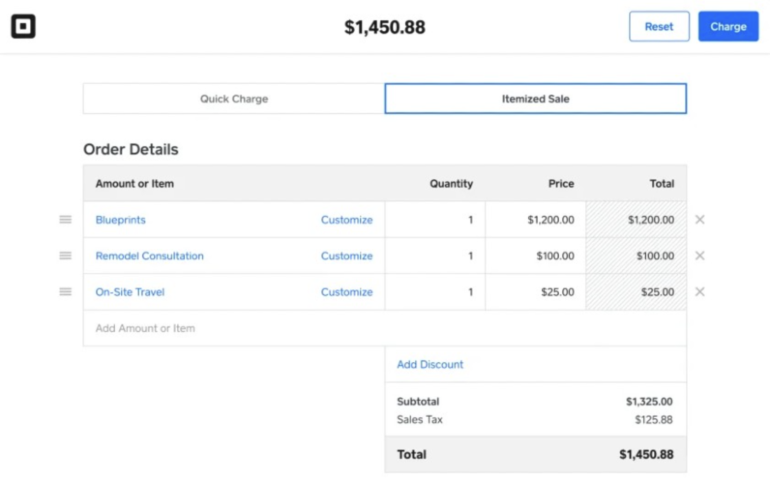

Square provides a comprehensive suite of tools, including POS systems, invoicing, and online payment processing, with no monthly fees, catering well to small businesses. It also offers features and tools that support enterprise-level operations, particularly for multi-location retailers, franchises, and high-volume sellers.

Why I chose Square

I chose Square for its overall user-friendliness. Square’s virtual terminal lets you store customer cards securely (via a card vault) for future use and set up recurring billing directly from the platform. It also has built-in fields for tips, internal notes, customer info, and itemized billing, which are uncommon in many virtual terminal interfaces and at no extra cost. I also like how Square handles the PCI compliance, so its merchants don’t have to worry about self-validation.

Like Helcim, Square’s virtual terminal works in its own ecosystem by default. However, while developer tools are also available, these are only accessible to enterprise-level accounts.

Pricing

- Monthly account fee: $0 to $165 (with POS software)

- Virtual terminal fee: $0/month

- Card-present rate: 2.6% + 15 cents

- Card-not-present rate: 2.9% + 30 cents

- Keyed-in rate: 3.5% + 15 cents

- ACH fee: 1%, minimum $1

- Invoice fee: $0 to $20

- Chargeback fee: Waived up to $250 per month

Features

- Supported payment methods: Supports major credit cards and ACH bank transfers, plus enables saving customer cards on file for future or recurring payments within the terminal interface. You can also accept in-person swipe, chip, and contactless options by connecting a card reader.

- Integration capabilities: Offers a unified ecosystem, seamlessly connecting tools like POS, Invoices, Appointments, Online Checkout, and Loyalty for a centralized business workflow. Additionally, it provides developer-friendly APIs and integrates with popular third-party platforms such as QuickBooks, WooCommerce, and Zapier for expanded functionality.

- Scalability: Multi-user access with role-based permissions and custom branding options like invoice logos and domain settings. Its built-in reporting tools provide real-time insights and sales tracking, though deeper customization may require premium tiers or third-party integrations.

- Workflow integration: You will need a Square merchant account platform to access the virtual terminal. This allows you to accept remote payments directly from a web browser and sync in real time with your appointments, invoices, inventory, and customer records.

- Security: Safeguards virtual terminal transactions with industry-standard PCI DSS compliance, end-to-end encryption, and secure tokenization of payment data. Additionally, Square monitors for fraud in real time and does not store sensitive card information on devices, enhancing transaction security across its platform.

- Ease of use and setup: Businesses can start accepting payments immediately after account creation with no need for merchant approval or additional hardware. Its clean, intuitive interface requires minimal training, making it ideal for non-technical users or teams needing a fast remote payment solution.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Payment Depot: Best for growing remote sales

Our rating: 4.26 out of 5

Powered by its parent company Stax, Payment Depot offers custom-based interchange-plus rates ideal for mid-volume, growing businesses. This means businesses only pay for services they actually need, at competitive rates, and without the heavy monthly fees.

Why I chose Payment Depot

Payment Depot’s strength is its versatility, allowing it to work with payment gateways that already have their own virtual terminal. This allows businesses migrating from a different provider to continue using their current platform with little to no interruption. At the same time, it allows businesses to enjoy lower transaction rates while processing larger volumes.

That said, Payment Depot is only for U.S. merchants and does not support instant funding requests. Consider alternatives like Chase for faster access to funds and for more international reach.

Pricing

You can negotiate with Payment Depot for custom fees based on your sales volume and payment processing needs.

- Monthly account fee: $0

- Virtual terminal fee: Custom rate

- Card-present rate: Custom rate

- Card-not-present rate: Custom rate

- Keyed-in rate: Custom rate

- ACH fee: Custom rate

- Invoice fee: Custom rate

- Chargeback fee: $25

Features

- Supported payment methods: Supports credit card payments from major card networks as well as ACH bank transfers.

- Integration capabilities: Relies on its partnerships with leading payment gateways to connect with various third-party tools, such as QuickBooks, WooCommerce, and CRMs. While it offers flexibility through these gateways, it makes setup and customization more dependent on the chosen gateway provider.

- Scalability: The custom platform solution is designed to optimize scalability. It also offers robust reporting tools, allowing businesses to access in-depth insights into their transactions and operations.

- Workflow integration: Integrates with your current workflow primarily through its compatibility with popular payment gateways, allowing businesses to connect the virtual terminal to existing tools like QuickBooks, shopping carts, and CRMs.

- Security: Payment Depot secures virtual terminal transactions through PCI-compliant gateways and encryption protocols that protect cardholder data during transmission and storage. It partners with top-tier processors, such as Fiserv, to ensure secure infrastructure, while also supporting tokenization and fraud prevention tools for added protection.

- Ease of use and setup: Requires only a merchant account and gateway activation, often completed within a few business days. Its web-based interface is straightforward and user-friendly; however, businesses new to payment gateways may require some guidance during the initial configuration.

Pros and cons

| Pros | Cons |

|---|---|

|

|

PaymentCloud: Best for high-risk merchants

Our rating: 4.15 out of 5

PaymentCloud specializes in serving high-risk industries by providing customized payment processing solutions, dedicated support, and access to multiple backend processors. Its virtual terminal enables secure, manual card entry and integrates with a wide range of CRMs and e-commerce platforms, making it ideal for remote or phone-based sales.

Why I chose PaymentCloud

Like Payment Depot, PaymentCloud offers customized payment processing services. However, I chose PaymentCloud because of its ability to serve businesses in industries that often have the biggest need for mail order/ telephone order (MOTO) payments, such as teleservices. It provides businesses with the option to continue using their current payment gateway with the virtual terminal or design a completely customized platform.

That said, the biggest downside to custom solutions for high-risk merchants is expensive and less-than-transparent pricing. See our guide to other top high-risk merchant services for more alternatives.

Pricing

PaymentCloud’s fees are custom, based on your sales volume and payment processing requirements. It can also adopt your preferred pricing structure (flat-rate, custom interchange plus, tiered). Below are examples of PaymentCloud’s typical fees.

- Monthly account fee: $10 to $45

- One-time virtual terminal fee: $15 to $45

- Low-risk transaction fees: 2% to 3.1%

- Mid-risk transaction fees: 2.25% to 3.4%

- High-risk transaction fees: 2.7% to 4.3%

- Payment gateway monthly fee: $15

- Chargeback fee: $25 to $45

Features

- Supported payment methods: Supports all major card brands and ACH transactions.

- Integration capabilities: Strong integration capabilities through partnerships with over 100 platforms, including Shopify, WooCommerce, SAP, and Microsoft Dynamics. It also provides an accessible API and supports gateway-based connections.

- Scalability: Can provide you with a custom-developed payment platform that supports tailored branding and multi-user access, plus robust reporting, making it adaptable for growing teams and complex business structures.

- Workflow integration: Integrates seamlessly into your current workflow through its wide compatibility with over 100 platforms via supported gateways and custom APIs. This flexibility enables businesses to maintain their existing systems while enhancing payment functionality, particularly in service-intensive or high-risk operational environments.

- Security: PaymentCloud protects virtual terminal transactions with PCI DSS compliance, end-to-end encryption, and tokenization to securely handle sensitive payment data. It also offers advanced fraud prevention tools and chargeback management features, making it well-suited for high-risk and regulated industries.

- Ease of use and setup: Offers a relatively smooth setup process, with dedicated onboarding specialists guiding businesses through merchant account approval and platform configuration. Its user interface is intuitive and streamlined, making it easy to manage payments, customer data, and reporting, even for new users.

Pros and cons

| Pros | Cons |

|---|---|

|

|

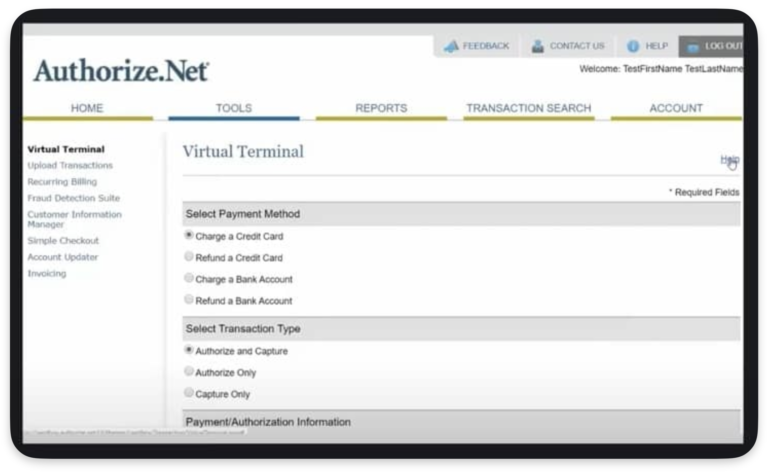

Chase Payment Solutions: Best for cross-border transactions

Our rating: 4.14 out of 5

Chase offers seamless integration between merchant services and banking, providing a unified solution for businesses already using Chase’s banking services. Its virtual terminal, Orbital, is well-suited for small to large businesses that need to handle cross-border transactions, offering the stability and global reach of one of the largest financial institutions.

Why I chose Chase Payment Solutions

I chose Chase because, unlike Helcim, Square, and PaymentCloud, Chase supports businesses looking to handle currency beyond their own. This makes Chase ideal for businesses with customers or partners abroad. Its virtual terminal handles multicurrency processing and other international banking services, with fraud protection tools and real-time reporting, to help manage risk and track global sales.

However, the system can be less user-friendly and slower to set up compared to more modern, tech-forward alternatives. If you need multicurrency management on an easy-to-use platform, consider PayPal instead.

Pricing

- Monthly account fee: $0 to $15

- Virtual terminal fee: From $9.99/month

- Card-present rate: 2.6% + 10 cents

- Card-not-present rate: 2.9% + 25 cents

- Keyed-in rate: 3.5% + 10 cents

- ACH fee: $2.50 for the first 10 transactions, 15 cents for additional transactions

- Invoice fee: $0

- Chargeback fee: $25

Features

- Supported payment methods: Manual entry of all major card brands, ACH, echecks, and other bank transfers.

- Integration capabilities: Integrates with a variety of third-party systems through the Orbital Gateway, supporting connections to e-commerce platforms, accounting software, and CRMs.

- Scalability: Offers enterprise-grade tools, including multi-location management, advanced reporting, and support for high-volume processing. Its Orbital Virtual Terminal and backend infrastructure are designed to accommodate growing transaction volumes and complex organizational needs, including tailored merchant services for larger businesses.

- Workflow integration: Offers API access for custom integrations, enabling businesses to embed payment functionality into proprietary systems or broader enterprise workflows.

- Security: Chase’s Orbital Virtual Terminal utilizes 128-bit Secure Socket Layer (SSL) encryption and adheres to PCI DSS Level 1 compliance standards. It also incorporates tokenization, Address Verification System (AVS), Card Verification Values (CVV/CID), and Account Verification.

- Ease of use and setup: Typically involves a merchant account approval process and gateway configuration, guided by Chase’s support team to ensure proper implementation. Once set up, the platform offers a straightforward, browser-based interface with intuitive navigation, making it accessible for both new users and enterprise-level staff.

Pros and cons

| Pros | Cons |

|---|---|

|

|

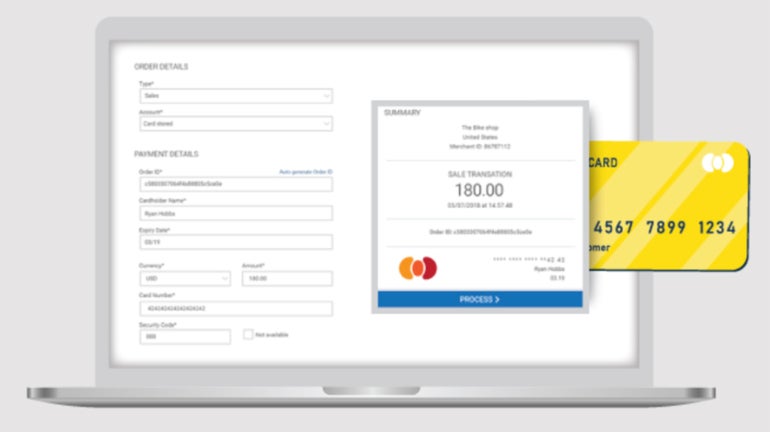

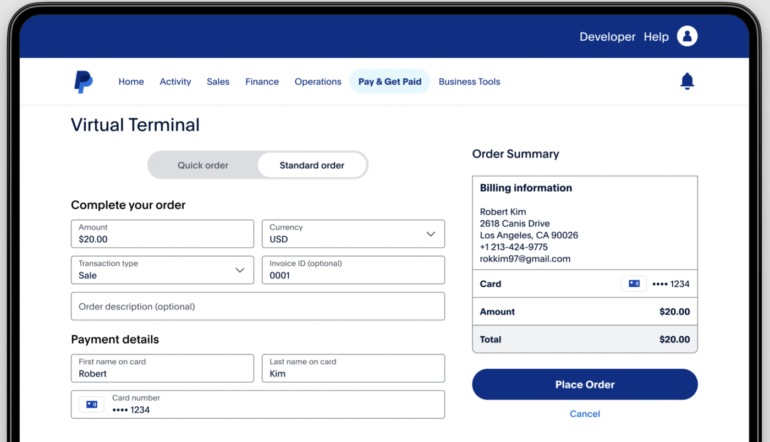

PayPal: Best for occasional sales

Our rating: 4.09 out of 5

PayPal is a globally recognized digital payment platform known for its ease of use, widespread consumer trust, and ability to facilitate secure online transactions for individuals and businesses. It provides a built-in virtual terminal that works seamlessly with PayPal’s broader ecosystem, enabling features like recurring billing, multi-user access, and PayPal-branded checkout options.

Why I chose PayPal

PayPal completes my list of best virtual terminal platforms. With the platform having more than 430 million active users at the beginning of 2025, being able to say “yes” when asked, “Do you take PayPal?” is an advantage for businesses. Like Chase, PayPal allows you to accept payments in other currencies, with the amount automatically converted. While it only accepts credit and debit cards, I like how PayPal also lets you process refunds, authorize future payments, and even automatically generate a packing slip.

The main drawback, however, is that PayPal charges a monthly fee to use the virtual terminal. That and the flat-rate fee can easily eat up a small business’s bottom line if you use it regularly.

Pricing

- Monthly account fee: $0

- Virtual terminal fee: $30/month

- Card-present rate: 2.29% + fixed fee (9 cents for US merchants)

- Card-not-present rate: 2.89% to 2.99% + fixed fee (29 to 49 cents for US merchants)

- Keyed-in rate: 3.39% + fixed fee (29 cents for US merchants)

- Venmo/ Standard PayPal checkout fee: 3.49% + 49 cents

- ACH fee: 0.8%, $5 cap

- Invoice fee: $14.99

- Chargeback fee: $15-$20

Features

- Supported payment methods: Accepts credit and debit cards from major brands.

- Integration capabilities: Compatible with major e-commerce platforms, accounting tools, and CRMs like Shopify, WooCommerce, QuickBooks, and Salesforce. It also provides robust developer APIs for custom integrations, allowing businesses to embed payment processing into tailored workflows or proprietary systems.

- Scalability: Offers multi-user access, customizable payment pages, and detailed transaction reporting to support growing business needs. Its infrastructure accommodates businesses of all sizes, with features like recurring billing, global payment acceptance, and seamless integration across sales channels.

- Workflow integration: Like Square and Helcim, PayPal’s virtual terminal works within the PayPal ecosystem, though you can easily integrate it if you use popular e-commerce and CRM platforms.

- Security: PayPal secures virtual terminal transactions with advanced encryption, PCI DSS compliance, and tokenization to ensure sensitive payment data is protected throughout the transaction process. It also features real-time fraud detection, buyer and seller protection programs, and secure login protocols, such as two-factor authentication, to safeguard both businesses and their customers.

- Ease of use and setup: Businesses can activate it directly from their PayPal Business account without needing a separate merchant provider or hardware. Its user-friendly, web-based interface makes processing payments intuitive, with minimal training required for staff to start accepting transactions immediately.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Methodology

To build this guide, I put together an initial list of 17 popular virtual terminal service providers. From there, I evaluated each software against four criteria and 22 data points, focusing on pricing, key features, and scalability.

- Pricing (40%): Excellent pricing transparency and flexibility, with no virtual terminal fee, free or competitive merchant account costs, a flexible or interchange-plus pricing structure, and a pay-as-you-go or monthly contract.

- Virtual terminal features (30%): Supports comprehensive functionality including invoice payments, Level 2/3 B2B data processing, cross-border transactions, all major payment methods (credit cards, ACH, echecks), CRM/inventory integration, automatic digital receipts, and secure card vault storage, ideally without additional fees.

- Ease of use (30%): Seamless usability with built-in merchant account setup, out-of-the-box activation, and free same-day funding. Bonus points are awarded for the quality of customer support, fraud monitoring, and chargeback management, with top marks given to platforms that deliver excellence across all service and security dimensions.

- Expert score (20%): Overall assessment of each provider that factors in pricing transparency and value, user experience (including UI and account stability), popularity based on user reviews, and scalability for growing businesses.

The scores were based on my personal experience exploring and testing each platform (when available), plus feedback from real-life users that I gathered from reputable review sites. I then created my list of the top six that stood out for a variety of business needs.

Choosing the right virtual terminal that can help grow your business

A virtual terminal isn’t just a payment tool, it’s a growth partner. So if your business requires this feature for everyday sales, it’s crucial to find the right platform with key features that provide seamless support as your needs grow.

For solopreneur or microbusiness ($0-$10K/month)

If your business is at this stage, simplicity and affordability should be a top priority. Solopreneurs and microbusinesses benefit from virtual terminals that require no hardware or monthly fees. So, the primary focus should be on accepting occasional payments via browser or mobile without needing a full point-of-sale setup.

Look for features such as:

- Basic manual card entry

- Mobile and browser-based access

- Simple invoicing or payment links

For growing small businesses ($10K-$50K/month)

As your business grows, you’ll likely have a small team, more frequent payments, and a greater need for automation. This is when multi-user access and better pricing models become crucial. Your virtual terminal should be able to support customer management, recurring billing, and basic system integrations.

Here are key features to look for:

- Multi-user access with permission settings

- Recurring billing setup

- Tokenized customer vaults

- CRM and invoicing software integrations

- Interchange-plus or subscription-based pricing

For mid-market/enterprise ($50K+/month)

At this stage, your priority shifts to integration, customization, and cost optimization. You’ll need a virtual terminal that supports complex workflows, deeper integrations, and more advanced security and reporting features.

Make sure to look for these advanced capabilities in your virtual terminal:

- API access for ERP or CRM integration

- Level 2/3 data support for B2B transaction savings

- Dedicated account managers and custom rates

- Advanced fraud detection and audit logging

Virtual terminal challenges and best practices

Card networks charge the highest rates for manually keyed-in transactions, which are used on a virtual terminal. This is due to the higher risk associated with the handling of payment information. So, if your revenue depends on virtual terminal transactions, consider the following best practices to protect your bottom line.

To avoid errors from manual entry:

- Save repeat customers in a secure vault for one-click repeat billing

- Use a provider with recurring billing and invoice automation

- Integrate with your CRM or accounting system to auto-fill fields

To mitigate the risk of fraud due to limited customer verification:

- Use secure authorization forms for large orders or first-time clients

- Enable 3D Secure if available through your provider

- Combine the virtual terminal with secure hosted payment links for self-service verification

To reduce the cost of using a virtual terminal:

- Choose a provider with interchange-plus pricing or volume-based discounts (e.g., Helcim, Payment Depot)

- Encourage high-value clients to pay via ACH or wire transfer when possible

- Negotiate lower rates with your provider as your volume grows

In today’s evolving consumer landscape, the best virtual terminals should be built to scale. Whatever your business size, the right provider can support you with tools to save time, reduce costs, and serve clients better. Evaluate where you are now, and plan for what you’ll need next.