QuickBooks Online is one of the most popular accounting software choices for small businesses in the US. It’s notably simple to set up, but it’s even easier with a step-by-step guide to explain each part of the process for you. Once you’ve signed up for a QuickBooks Online plan, log in to your online account and pull it up alongside this guide. We’ll walk you through how to set up QuickBooks Online for the first time.

FreshBooks

Employees per Company Size

Micro (0-49), Small (50-249), Medium (250-999), Large (1,000-4,999), Enterprise (5,000+)

Medium (250-999 Employees), Large (1,000-4,999 Employees), Enterprise (5,000+ Employees)

Medium, Large, Enterprise

Step 1: Enter basic business information

QuickBooks uses a clean and modern interface called Fusion to guide you through its setup wizard. It starts by collecting your basic business details and then walks you through options to import data from spreadsheets, past accounting software, or another bookkeeping service. You’ll also answer a few questions about your business, such as:

- Is this business your sole source of income?

- How long have you owned this business?

- How is your business set up (e.g., sole proprietorship, partnership, nonprofit)?

- What industry does your business participate in?

- What is your main role at your company (e.g., owner, accountant, employee)?

During setup, QuickBooks encourages you to connect third-party apps, integrate with e-commerce platforms, and take advantage of tools like payroll and payments. Pop-up offers may appear for discounts on these services and for adding additional company files. Navigation is fully customizable, and the setup process is flexible. You can skip or revisit any section at any time, and the wizard will save your place automatically.

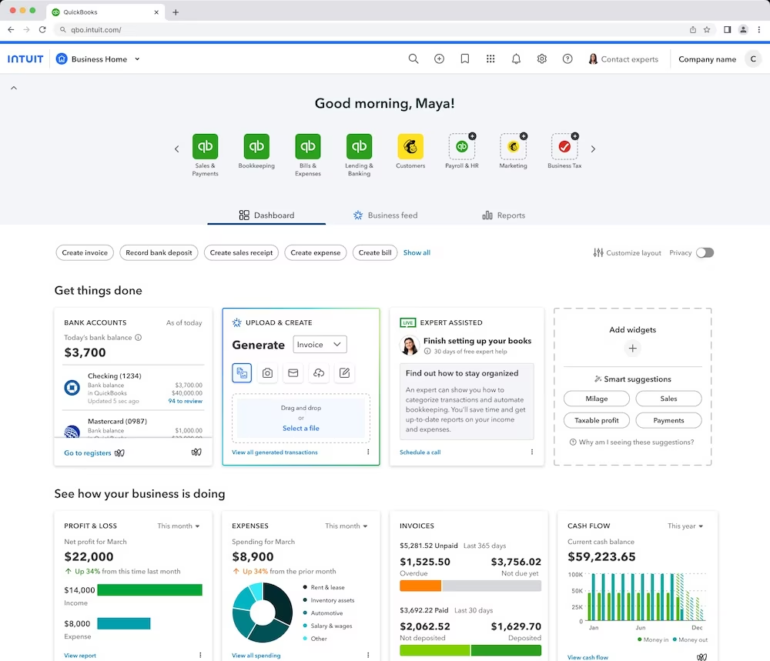

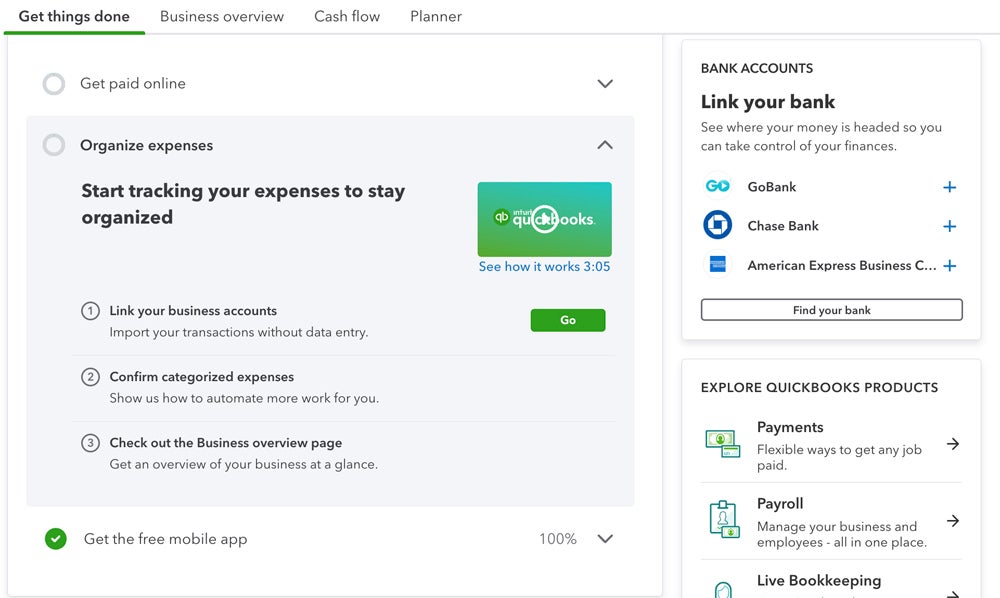

Step 2: Get to know your QuickBooks Online dashboard

Once you’ve completed QuickBooks’ initial questions about your business, you’ll land on a streamlined dashboard built on the Fusion interface. The layout features a compact, customizable left-hand menu alongside interactive widgets you can move or hide to suit your workflow. A setup checklist may appear as a sidebar or pop-up, guiding you through remaining tasks without disrupting your view.

Core tabs like “Get things done,” “Business overview,” “Cash flow,” and “Planner” are still available, but they’re now more dynamic and offer customization options so you can tailor the dashboard to your specific business needs.

A video should also pop up offering to give you a quick tour of the dashboard (I definitely recommend taking it). Additionally, since one of QuickBooks’ top selling points is its user-friendliness and intuitive UX, I recommend clicking through various tabs on the dashboard to familiarize yourself with the interface. Simply checking out the font and graphics helped me orient myself to QuickBooks’ style before I started entering information.

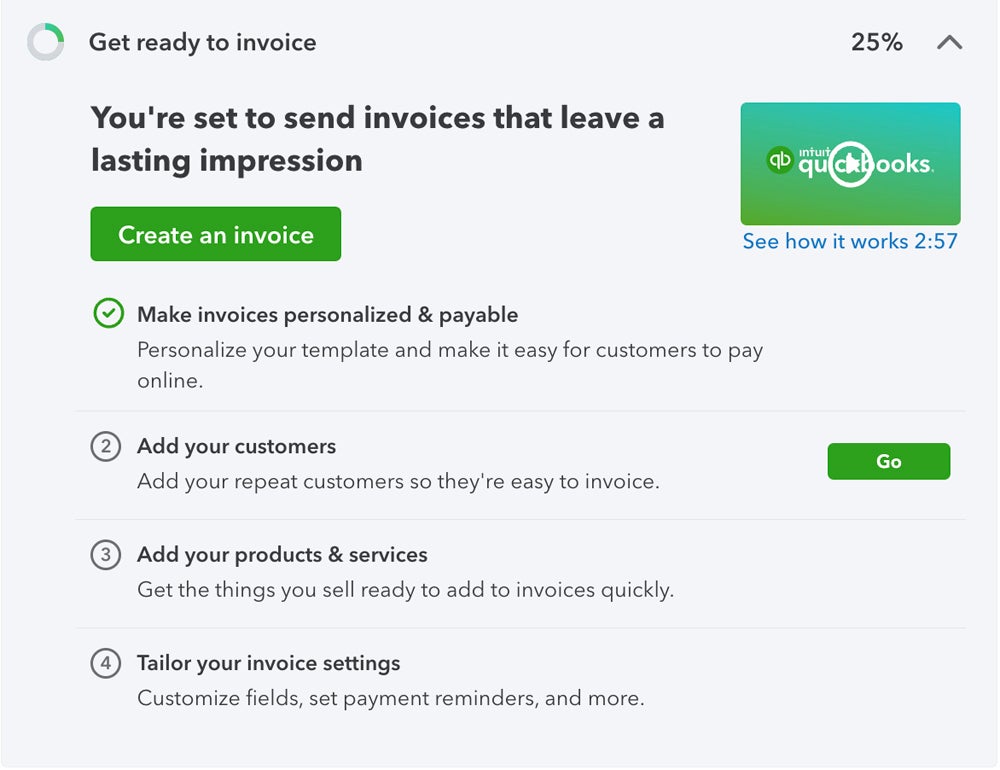

Step 3: Go through your QuickBooks Online setup checklist

Once you’re familiar with QuickBooks Online’s layout and style, you can start working through the setup checklist. Each major task includes a step-by-step guide with checkmarks for progress tracking and embedded videos that walk you through the process. You can complete these steps in any order, skip ones you’re not ready for, and return later — your progress will be saved automatically.

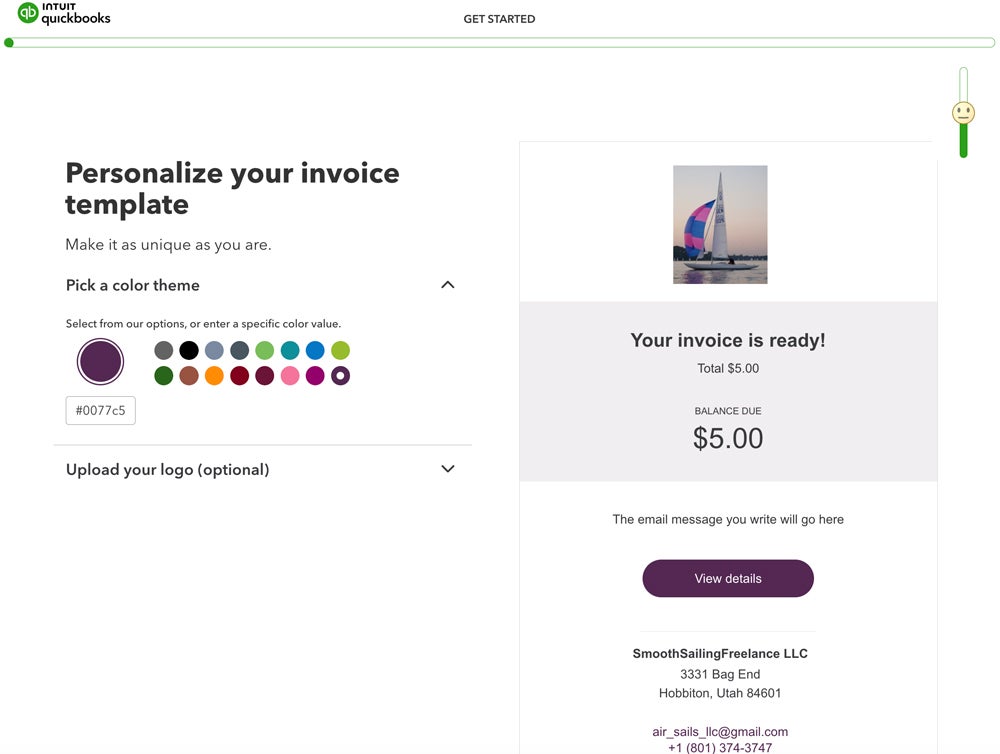

Create an invoice

QuickBooks makes it easy to create your first invoice using its built-in invoicing tool. You can personalize a template with your brand logo, color scheme, and business details. You can also create new custom fields: Simple Start allows one, Essentials and Plus support up to four, and Advanced up to 12.

You’ll be guided through these core steps:

- Personalize your invoice layout, choose payment methods, and apply branding.

- Add customer information and set up billing details.

- Enter products or services. Both service and non-inventory items can be created directly from the invoice screen.

- Fine-tune your invoice with optional customizations.

You can also enable payment options directly from the customization screen. QuickBooks Payments lets you accept ACH transfers, credit card payments, and send one-time payment links that expire after payment. You can toggle automatic reminders, apply late fees, and set recurring invoices — all without leaving the invoice setup flow.

As you complete each section, QuickBooks tracks your progress in real time with percentage indicators and checkmarks.

As you can see in the image below, if you enter basic business information after logging on to QuickBooks for the first time, the QuickBooks invoicing template will auto-populate with your business’s details and give you basic customization instructions.

If you’d like, you can customize more aspects of your invoice by adding payment instructions, setting up late fees, writing a default message to send with sales and automating invoice reminders.

Set up online payment acceptance

If you want to accept payments through QuickBooks, setting up QuickBooks Payments is quick and integrated into the setup checklist. You’ll need to:

- Verify your business info (name, address, phone, email).

- Provide your personal contact details.

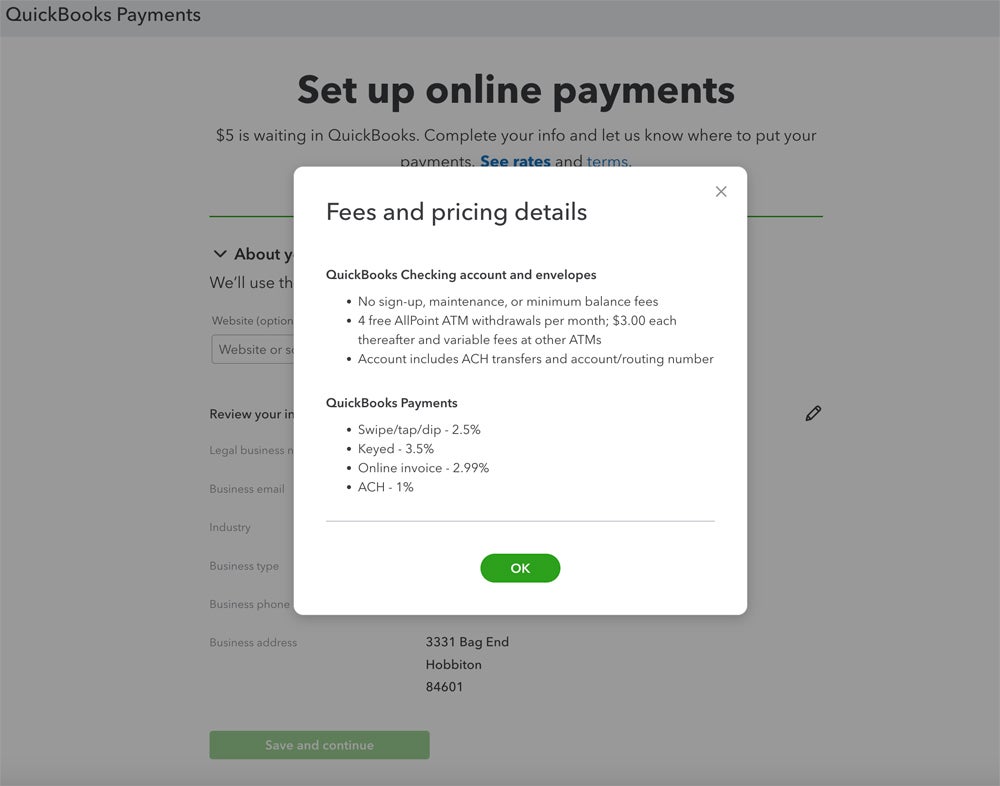

Once verified, you can start accepting online payments via card, ACH, or payment links. You’ll also have the option to order a QuickBooks card reader for in-person transactions. Standard transaction fees apply:

- Online invoice: 2.99%

- ACH payments: 1%

- Card swipes/taps/dips: 2.5%

- Keyed-in cards: 3.5%

Transaction Fees in QuickBooks Checking (Source: Intuit QuickBooks)As a bonus, QuickBooks deposits $5 into your linked checking account once setup is complete to help you test the process.

Optional setup step: Open a QuickBooks Checking account

You’re not required to open a QuickBooks Checking account to accept payments, but it’s offered as a recommended option. You can either connect your current bank or apply for a QuickBooks Checking account. Approval is typically fast, and your debit card should arrive within seven business days.

Organize expenses

QuickBooks helps you stay on top of your business expenses from day one with three main steps:

- Connect your bank accounts and any credit cards: Use the built-in search tool to link your financial institutions. QuickBooks imports the last 90 days of transactions by default, but you can upload records from up to a year prior for better historical accuracy.

- Confirm that QuickBooks has categorized your expenses correctly: QuickBooks auto-categorizes imported expenses, but you’ll be prompted to review and confirm the tags. If anything’s off, you can adjust the category or create a custom one. The more accurate your initial tags, the better QuickBooks becomes at categorizing transactions automatically over time.

- Explore QuickBooks’ overview of your finances: Navigate to the “Business overview” tab for a snapshot of your financial activity, including categorized expenses, invoice activity, and profit and loss summaries.

Linking Bank Accounts (Source: Intuit QuickBooks)

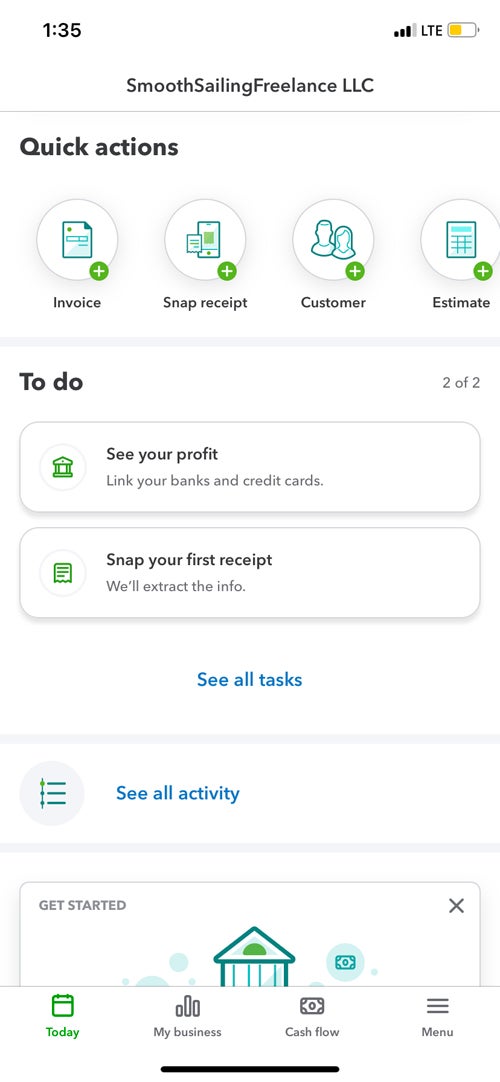

Download the QuickBooks Online mobile app

You may have already downloaded the QuickBooks accounting app earlier in the setup process, but if you haven’t, now’s the time to do so. The app is easy to set up and gives you the same basic financial overview as the dashboard interface. You can also use it to scan and upload receipts, send mobile invoices, and track mileage.

QuickBooks Online Mobile App (Source: Intuit QuickBooks)

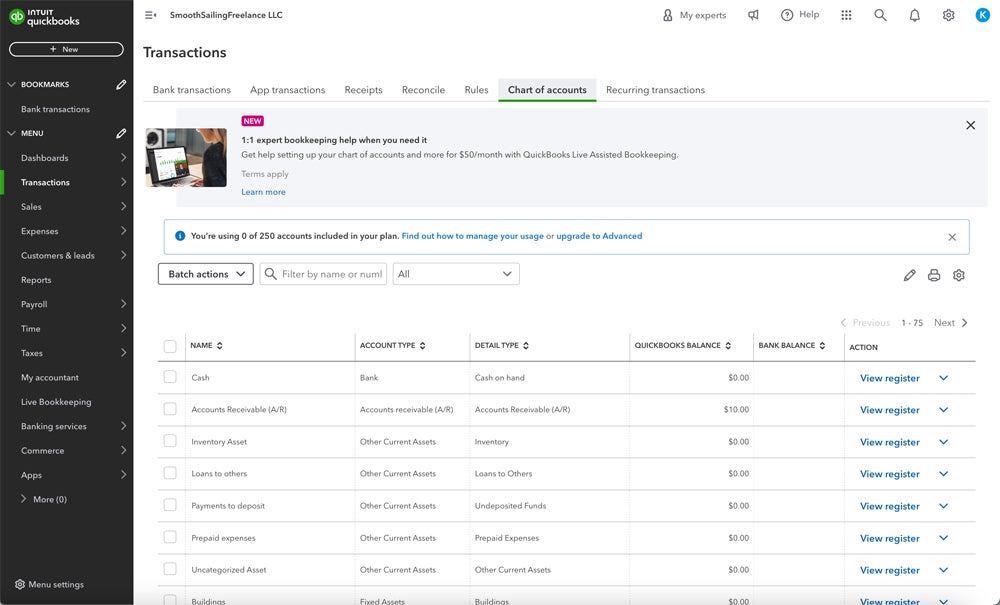

Step 4: Configure your chart of accounts

A chart of accounts is essential for accurate double-entry bookkeeping. If you’re unsure how to build one, you can invite your accountant to collaborate via the “My accountant” tab. QuickBooks lets you share access at no extra cost per seat.

Chart of Accounts in QuickBooks (Source: Intuit QuickBooks)You can access your chart of accounts from either the “Accounting” or “Transactions” menu. From there, use the “New” button to add accounts. If you’re setting up sub-accounts, you’ll choose a parent account directly within the account setup dialog, which streamlines the process, though some users may find the steps slightly less intuitive than before.

QuickBooks still offers up to 250 accounts under the Simple Start plan, which is typically more than enough for freelancers, solopreneurs, and smaller businesses. Most new users won’t need sub-accounts, but if you do want to track specific income or expense categories in more detail, the customization tools make it easy to build that structure.

If you’re migrating from another accounting system or starting mid-year, you’ll also be prompted to enter opening balances for each account as you create them. And if you need help setting things up, the “Live Bookkeeping” tab connects you with a QuickBooks expert who can organize your chart of accounts and maintain your books on a monthly basis.

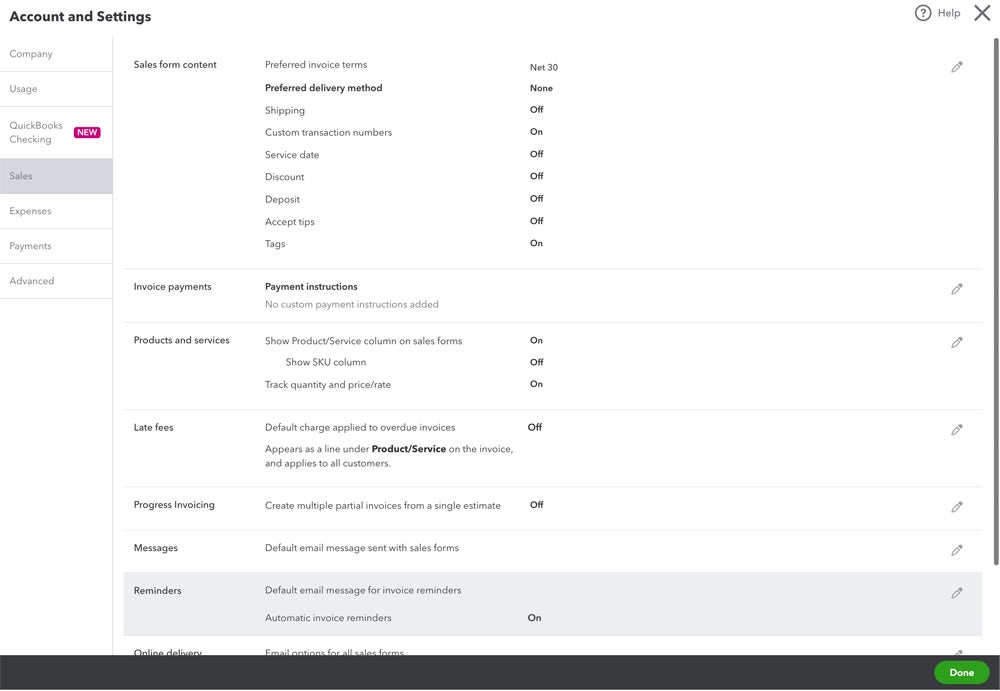

Step 5: Customize any other aspects of your QuickBooks account

QuickBooks gives you extensive control over how your workspace looks and functions. From the “Get things done,” “Business overview,” “Cash flow,” and “Planner” dashboards to your sidebar bookmarks, nearly every element can be tailored to match how you work best. I found the drag-and-drop layout especially helpful, and it took just a few clicks to move my most-used tools front and center.

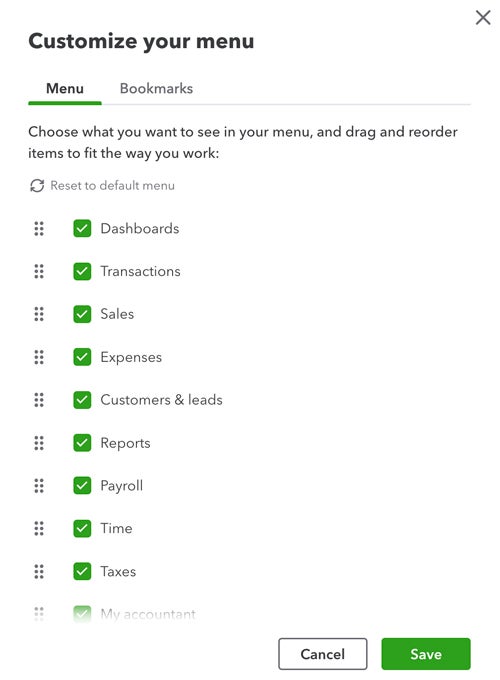

Menu Customization (Source: Intuit QuickBooks)To adjust your interface or account settings, click the gear icon in the top right and select “Account and settings.” Here, you can update your company info, billing preferences, and core feature settings.

Need to bring in team members? Head to “Manage users” from the settings menu. QuickBooks lets you assign granular roles such as admin, standard user, or reports-only, and apply detailed access restrictions so each user only sees what they need.

You can also reorganize your menu and dashboard widgets to highlight the features you use most. For example, I removed “Payroll” from my dashboard view and bumped “Customers & leads” to the top of the sidebar, just because it fits my workflow better. If you ever want to start over, there’s a quick “Reset to default menu” option that restores the original layout.

Further resources

Reading how-to guides like ours is a great first step to setting up your QuickBooks Online account, but we’re just one resource among many. There’s plenty of information at your fingertips to help you make the most of your QuickBooks account, starting with these:

QuickBooks’ online setup guide

With its comprehensive setup guide, QuickBooks showcases useful setup videos, hosts setup seminars, and includes free guided setup for all first-time users.

One-time free setup assistance

If you’re new to QuickBooks, make sure to take advantage of the free setup assistance. It’s the best way to ensure your account is set up to your exact preferences, and it also gives you the perfect opportunity to get advice that will help you make the most of your QuickBooks account.

Note that free setup assistance is unavailable if you opt into QuickBooks’ free trial.

QuickBooks’ customer service team

In the top right corner of your QuickBooks dashboard, you’ll see a question mark icon next to the word “Help.” At any point during your setup experience, you can click the icon to access QuickBooks’ chatbot, search for helpful articles, or request help from a live customer service agent.

YouTube tutorials

Do you prefer auditory or visual instructions over written ones? QuickBooks’ official YouTube page hosts its vast library of how-to videos. You may also find useful guides from third-party reviewers, but double-check the content creator’s credentials before relying on their videos for guidance — and be wary of any third-party sources pushing their own paid products or services alongside their QuickBooks setup guide.

Frequently asked questions (FAQs)

How do I set up a QuickBooks Online account?

To set up a QuickBooks Online account, start by visiting QuickBooks’ site to choose an accounting plan. After signing up for either a 30-day free trial or 50% off your plan’s base cost for three months, you’ll be directed to a sign-in page where you can choose your username and password. From there, QuickBooks’ setup wizard will prompt you to enter your business’s information, sync any third-party apps you’re already using, customize invoices, and start tracking finances.

What information do I need to set up QuickBooks Online?

When setting up a new QuickBooks Online account, you’ll enter key details like your name, business name, address, and Employer Identification Number. You’ll also have the option to sync your bank or credit card accounts to start tracking expenses and generating reports right away. If you’re migrating from another bookkeeping tool or spreadsheet, it’s helpful to have those records ready.

Can I have two companies on one QuickBooks Online account?

No, you can’t. You can only have one account per company at a time. If you want to use QuickBooks for multiple companies, you need to subscribe to a separate account for each.